At Konnect Financial Services, we understand that securing a home loans in Geelong can be a complex journey, especially in today’s fluctuating economic landscape. Our experience and dedication ensure that we provide you with the best loan options suited to your unique situation.

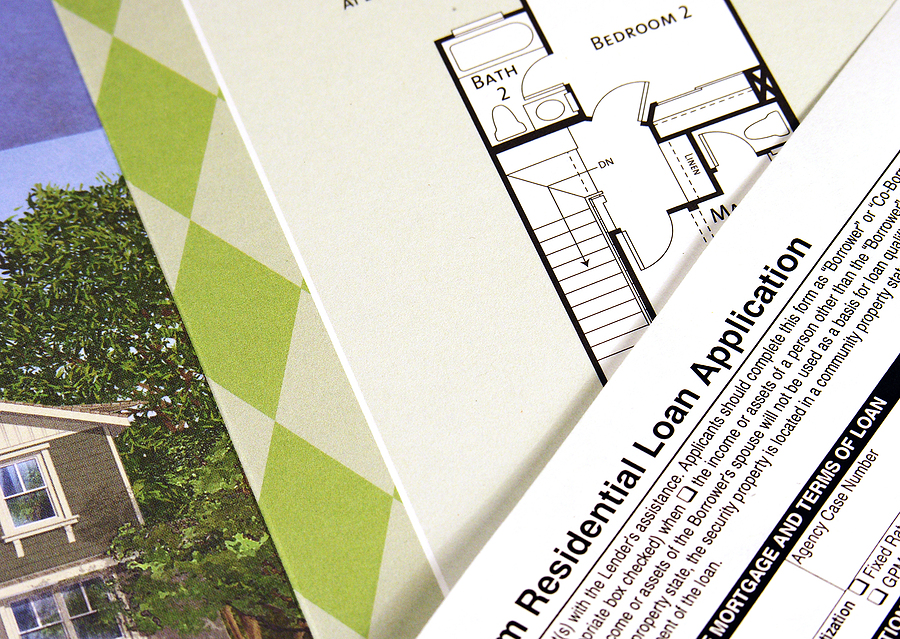

The growing challenge of honest home loan applications

In today’s financial landscape, the practice of misrepresenting information on home loan applications — known as “liar loans” — is becoming increasingly prevalent. In an article by ABC News business reported Nassim Khadem, Sean Quagliani of Fortiro, whose technology aids banks in detecting fraudulent documents, notes a troubling threefold increase in such cases.

This trend is a direct consequence of the financial pressures exerted by rising interest rates, the higher cost of living, and surging house prices. Quagliani explains that desperate borrowers often resort to altering documents, such as inflating income on payslips or omitting expenses, to improve their chances of securing a loan.

This surge in dishonesty is partly driven by the challenging dilemma faced by prospective borrowers. In a market where securing a home loan becomes increasingly difficult, some individuals feel compelled to choose between presenting factual information and potentially missing out on a home purchase. However, the ramifications of submitting false information are severe. Doctoring documents or lying on loan applications can lead to the invalidation of the loan contract, mortgage default, and in extreme cases, legal consequences including fraud charges.

Moreover, the increase in “liar loans” has been exacerbated by the easy access to digital tools for fabricating documents. The online nature of many loan applications provides a seemingly simple avenue for dishonesty. Quagliani highlights the ease with which bank statements and payslips can be falsified using online templates and editing tools. While lenders are improving their methods to detect fraud, the proliferation of these tools presents an ongoing challenge.

This situation is further complicated by the changing landscape of home loan regulations and market dynamics. For instance, as interest rates continue to fluctuate and property prices rise, more Australians find it challenging to qualify for new home loans, leading some to resort to dishonest means.

The data indicates a concerning trend where arrears — borrowers missing mortgage repayments — are expected to increase, potentially leading to defaults and forced home repossessions in severe cases.

Our approach to responsible lending

Konnect Financial Services is committed to responsible lending practices. We understand the pressures of the current market but advocate for a truthful and clear approach to loan applications. Our goal is to provide sustainable and suitable home loan solutions that consider your long-term financial well-being.

Navigating market changes and home loan options in Geelong

The home loan market is constantly evolving, influenced by factors like interest rates and economic policies. Understanding these changes and how they affect your loan options is crucial. Our experts at Konnect Financial Services stay abreast of these developments, offering you the most current and beneficial advice for your situation.

Are you ready to explore your home loan options in Geelong with a team you can trust? Reach out to Konnect Financial Services today and embark on a journey towards your dream home with confidence.